Investing in the stock market can be rewarding when you follow the right strategy. Many investors struggle to know where to start, what stocks to buy, or when to buy them. If you’re looking for dependable advice, 5starsstocks.com staples could be your reliable starting point.

Will explain what “5starsstocks.com staples” are, why they matter, and how you can use them to build a strong and secure portfolio. We’ll also share tips to smartly apply their guidance, avoid traps, and enjoy steady long-term growth.

What are 5starsstocks.com Staples?

5starsstocks.com staples refer to companies that are consistently recommended by 5starsstocks.com, a trusted investment resource. These are not just trending or hype-based stocks. They are selected based on long-term stability, consistent performance, and market strength.

3 Key Criteria of 5starsstocks.com Staples:

- Stable Earnings and Growth: These companies show regular profits and upward trends.

- Strong Market Position: They are leaders in their industries.

- Trustworthy Management: Their leadership focuses on growth, not quick gains.

These staples are often household names. You use their products or services every day—groceries, utilities, healthcare, and more. Investing in these firms is like putting your money in strong pillars of the economy.

Why Choose 5starsstocks.com Staples?

You want investments that don’t make you nervous each time the market shakes. 5starsstocks.com staples offer peace of mind. They are reliable during both bull and bear markets.

Here’s Why You Should Consider Them:

- Lower Risk: These stocks tend to move less drastically.

- Regular Dividends: Most staples pay consistent dividends.

- Steady Growth: Long-term charts often show positive trends.

- Economic Insulation: When hard times hit, people still need essentials.

Staples are your safety net. They won’t always soar, but they rarely crash. By owning them, you prepare for both good and bad days in the market.

Top 7 Types of Companies in 5starsstocks.com Staples

Let’s explore the categories that dominate 5starsstocks.com staples and some sample stocks you might find.

1. Consumer Goods

These companies sell everyday items—food, beverages, personal care, and cleaning supplies.

- Procter & Gamble (PG)

- Coca-Cola (KO)

- PepsiCo (PEP)

2. Healthcare

People need medicine and health services regardless of the economy.

- Johnson & Johnson (JNJ)

- Pfizer (PFE)

- UnitedHealth Group (UNH)

3. Retail Supermarkets

Grocery chains that keep earning even in recessions.

- Walmart (WMT)

- Costco (COST)

- Kroger (KR)

4. Utilities

Power, water, and gas are always in demand.

- NextEra Energy (NEE)

- Duke Energy (DUK)

- Dominion Energy (D)

5. Telecom

Phones and internet are necessities, not luxuries.

- Verizon (VZ)

- AT&T (T)

- T-Mobile (TMUS)

6. Insurance

Many staples include top insurance providers.

- Allstate (ALL)

- Progressive (PGR)

- MetLife (MET)

7. Consumer Services

Fast food, cleaning, and other daily services remain stable.

- McDonald’s (MCD)

- Yum! Brands (YUM)

- Starbucks (SBUX)

When 5starsstocks.com staples list their picks, you’ll often find names from these sectors. They’re safe, essential, and resistant to economic changes.

Benefits of Investing in 5starsstocks.com Staples

You’re not just putting money randomly when you follow this list. You’re choosing stability, income, and peace of mind.

Benefits Include:

- Consistent Returns: These stocks often outperform tech during downturns.

- Lower Volatility: They don’t crash often. Even if they do, they bounce back.

- Easy to Understand: Their businesses are simple and familiar.

- Long-Term Focus: Over decades, they build serious wealth.

Let’s say you invested in Procter & Gamble twenty years ago. You would see major returns today—thanks to dividends and price growth.

How to Use 5starsstocks.com Staples in Your Portfolio

Ready to use this resource? Follow these simple steps:

- Visit the Site Weekly: Check the updated staple lists and read analyst notes.

- Start with 3–5 Staples: Don’t rush. Pick a few and learn their background.

- Diversify Across Sectors: Choose from different staples—like healthcare, utilities, and consumer goods.

- Set a Buy-and-Hold Goal: These are long-term plays, not quick hits.

- Reinvest Dividends: Use them to buy more shares automatically.

You don’t need to be rich to start. Even $50 per month can grow over time with consistent investing.

Sample Portfolio Using 5starsstocks.com Staples

Let’s build a sample diversified investment using this strategy:

| Company | Sector | Investment ($) | Reason |

|---|---|---|---|

| Procter & Gamble | Consumer Goods | 300 | Stable, global product leader |

| Johnson & Johnson | Healthcare | 250 | Supplies across pharma and medicine |

| Walmart | Retail | 200 | Strong performance during recessions |

| Duke Energy | Utilities | 200 | Steady and essential |

| Verizon | Telecom | 150 | Vital web and phone infrastructure |

| McDonald’s | Food Service | 150 | High brand loyalty, global reach |

Total: $1,250 in strong, defensive stocks.

You can adjust this example to your budget or goals.

Mistakes to Avoid When Buying Staples

Even though staples are safer, no investment is risk-free. Avoid common traps:

Avoid These Errors:

- Overpaying: Don’t buy just because the name is famous. Check valuations.

- Ignoring Red Flags: Even big names can get into lawsuits or reputational trouble.

- No Diversification: Don’t put all your cash into one type of staple.

- Short-Term Thinking: You won’t get rich overnight—give it years, not weeks.

Stick to facts and follow advice from verified sources like 5starsstocks.com staples.

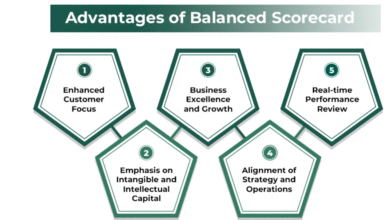

How 5starsstocks.com Analyzes Staples

Wondering how they pick the best companies?

They use a mix of:

- Financial Ratios: P/E, Dividend Yield, Debt-to-Equity

- Market Research: Trends in consumer behavior and spending

- Historical Ratings: Companies with A-ratings for years

- Watchlist Monitoring: Algorithms that alert for sudden dips or gains

This ensures that only the best-performing and sustainable companies appear in the staples list.

Testimonials From Everyday Investors

Still unsure? Many everyday investors have succeeded using 5starsstocks.com staples.

“I started with $100 per month and followed their stamp of approval. After three years, my portfolio had grown 36%!”

– Melissa H., Texas

“I used to be afraid of stocks. Now I just check 5starsstocks.com staples every few weeks.”

– Daniel M., New York

Their tools don’t require expert knowledge. They’re made for people just like you—workers, students, parents, or retirees.

How to Get Started Today

You don’t need a broker or a $10,000 bankroll. You only need:

- A free or low-cost brokerage account (like Fidelity or Robinhood)

- A beginner-friendly research tool—start with 5starsstocks.com staples

- A plan to invest monthly, even if small

Look up one staple stock tonight. Read about it. Watch its trend. Tomorrow, buy one share. That’s your first step.

Final Thoughts: The Long Game Wins

Smart investing doesn’t require panic, luck, or sky-high bets. It requires calm, patience, and strategy.

5starsstocks.com staples offer a rock-solid path to that strategy. They help you avoid noise and stick to what works. Use them to:

- Build wealth slowly but surely

- Protect yourself during economic downshifts

- Live life with more confidence in your financial future

Remember this rule: When in doubt, invest in what people can’t live without. That’s the heart of a strong staple—and the core purpose of 5starsstocks.com staples.

Start slow. Stay steady. Let time and consistency do their work.